AlRayan Bank

مجموعة إدارة الأصول

صندوق الريان لدول مجلس التعاون الخليجي

One of largest and most successful Sharia-compliant GCC funds in the region

AlRayan GCC Fund was launched in May 2010. Its success has stemmed from a belief that markets have significant opportunities, which allow the extraction of significant alpha (returns). The fund seeks to unearth uncommon value across GCC equities and sukuk.

With in-depth and rigorous analysis of companies (the sectors and countries they operate in), the fund applies an 18-24-month investment view aiming to capture material returns where current valuations do not fully reflect future prospects. Where necessary, the fund is more nimble when sufficiently attractive, shorter-term opportunities emerge.

We share our investors’ desire to focus on responsible investments, seeking to achieve sustainable growth. Importantly, studies by AlRayan Investment and others show this does not compromise performance, in fact principle-based investing has materially enhanced returns over the long term.

AlRayan GCC Fund invests across the six-nation, Gulf Cooperation Council (GCC). GCC members are Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates. The fund only invests in Sharia-compliant securities (as guided by our Shariah Supervisory Board) enabling investors to access compelling and responsible growth within the Gulf.

AlRayan Bank Q.P.S.C is the founder of AlRayan GCC Fund, which is managed by multi-award winning, Doha-based fund manager, AlRayan Investment LLC.

The fund is one of the largest Sharia-compliant GCC-focused fund in the region. From inception in 2010 till end-June 2021, it has returned 115%, after all fees have been considered.

Gulf equities are the primary focus

AlRayan GCC Fund focuses on regional, listed equities. The fund seeks to invest in companies with superior corporate governance, stronger management teams, durable market position and improving cash generation prospects. In addition to equities, the fund also invests in Shari’a-compliant fixed income (sukuk) and cash.

Ethical, responsible, sustainable: Our fund, as well as its investments meet our ethical investment principles, the foundation for responsible investing.

Experience

The fund’s multinational investment team has rich regional and global experience in equity and fixed income investing. Team members have strong track records of successful portfolio management and research.

Stock picking is key

We believe in-depth fundamental research is a pre-requisite to identifying long-term winners and unearthing value opportunities

In-house research

AlRayan Investment carries out in-house research on regional companies determined by our thematic screening process.

Low fees, enhanced performance

In order to enhance investor returns, AlRayan GCC Fund’s fees have been set competitively. One-off subscription fee, up to 1% Management fee of 1.25% of Net Asset Value (NAV) per annum. Management fee is charged on a monthly basis. Performance fee of 20% above the hurdle rate of 24%, to be charged, if any, every 2 years from June 2021 till May 2023.

This fee ensures fund manager interests are aligned with investors. If the fund delivers more than 24% return over a 24-month period, the fund manager is eligible to share 20% of the excess return. Example. If the fund returned 28% over 2-years (net of fees), the fund manager would share 20% of 4% or 0.8%, so net return would be 27.2%.

Minimum subscription

QAR 35,000 for individual investors QAR 350,000 for institutional investors

AlRayan GCC Fund (Q) and AlRayan GCC Fund (F)

AlRayan GCC Fund was previously known as AlRayan GCC Fund (Q). A separate fund, AlRayan GCC Fund (F) followed the same investment strategy as AlRayan GCC Fund (Q), but was reserved for non-Qatari investors with a base currency of US Dollars; the base currency of AlRayan GCC Fund (Q) was Qatari Riyals.

During 2019, AlRayan GCC Fund (Q) was renamed AlRayan GCC Fund. In October 2019, to allow benefits of greater scale, and after consultation with all investors, AlRayan GCC Fund and AlRayan GCC Fund (F) were merged. Investors in AlRayan GCC Fund (F) had their units swapped with those of AlRayan GCC Fund and AlRayan GCC Fund (F) became inactive.

This entire procedure was conducted with the approval, and under the scrutiny of the fund regulator, the Qatar Central Bank.

NAV / UNIT (QAR)

|

Ex Date |

Amount in QAR |

|

30-Jun-21 |

0.065 |

|

31-Dec-21 |

0.021 |

|

30-Jun-22 |

0.063 |

|

29-Dec-22 |

0.050 |

|

26-Jun-23 |

0.076 |

|

31-Dec-23 |

0.080 |

|

30-Jun-24 |

0.050 |

|

31-Dec-24 |

0.032 |

|

30-Jun-25 |

0.026 |

|

31-Dec-25 |

0.025 |

2025

2024

2023

2022

2021

Show old GCC Funds

AlRayan GCC Fund now offers daily subscription and redemption

AlRayan GCC Fund announces QAR 0.025 dividend distribution for second half of 2025

The Fund Manager has decided to distribute dividends based on the fund’s net asset value (NAV) as at 31 December 2025. All unit holders as per the records of the custodian on 31 December 2025 will be entitled to receive this dividend. Accordingly, NAV of 31 December 2025 will be the ex-date, reduced by the amount of the dividend payable. The dividend will be distributed in cash, or in kind (additional units), based on the selection of each unit holder; where no selection has been made, dividends will be paid in kind.

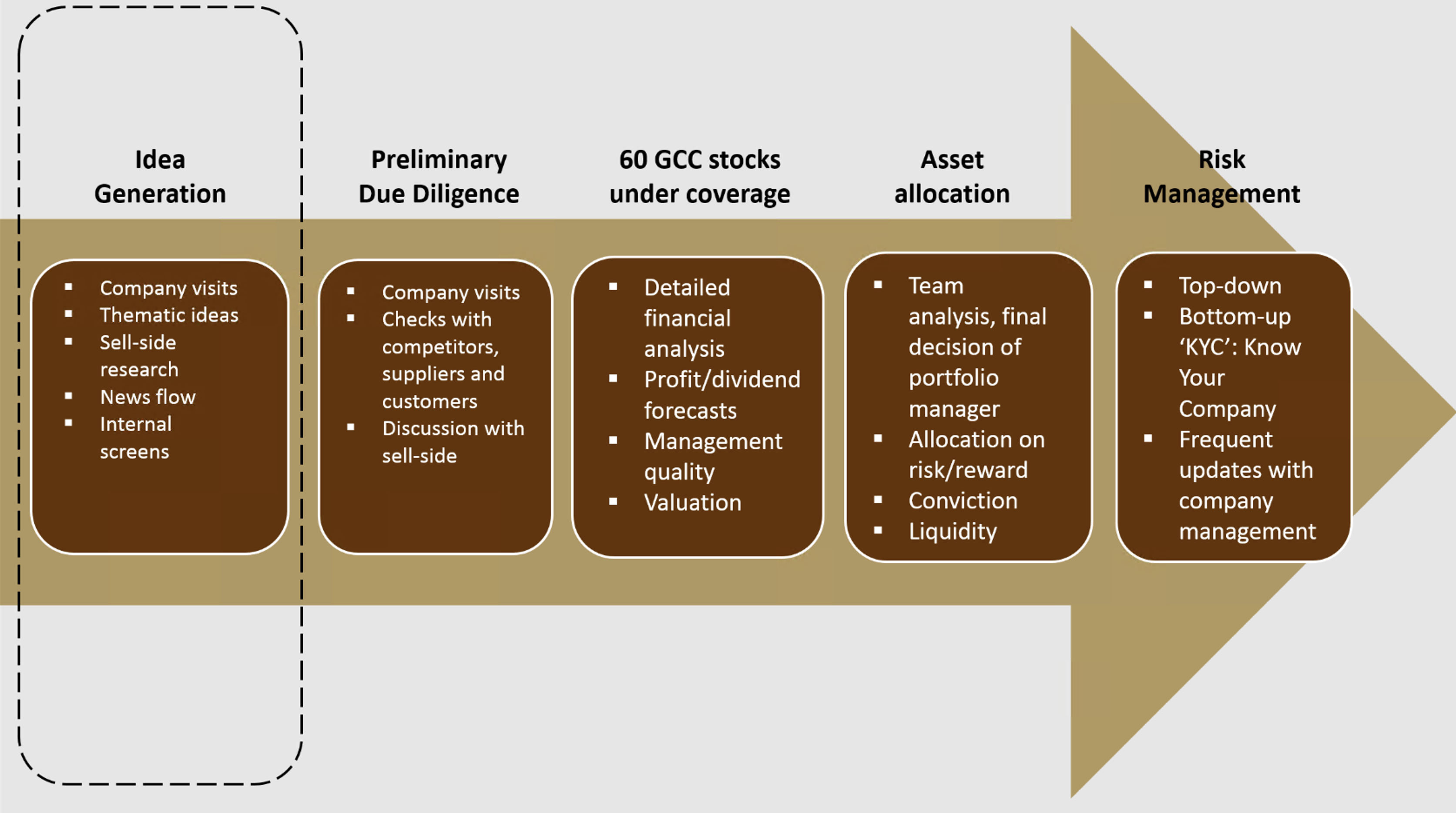

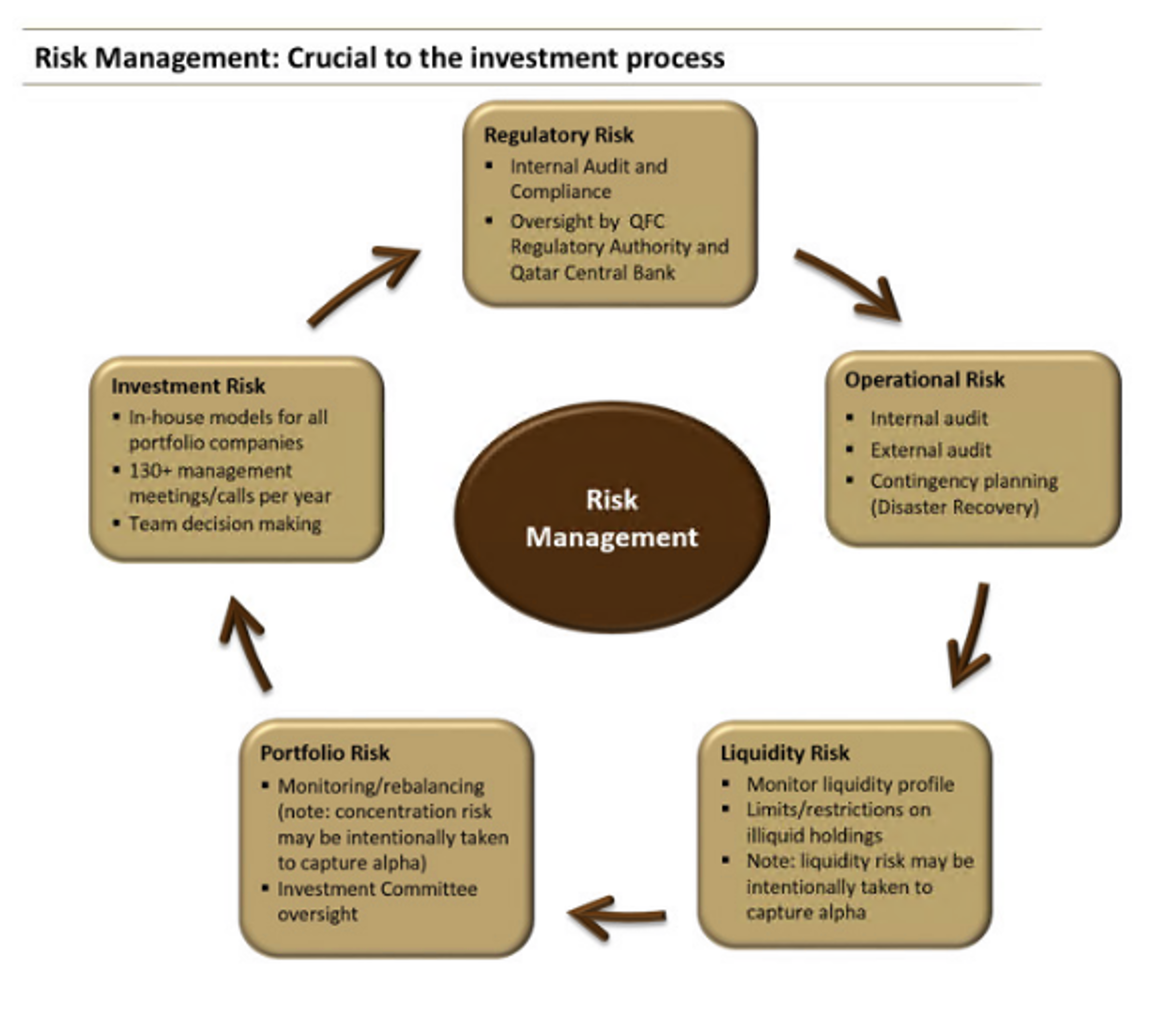

The fund’s Investment Strategy and Process seeks to capture outstanding medium to long-term opportunities in leading regional companies operating in a sustainable manner. We have identified secular growth trends and investing in line with these is key to delivering significant returns. Key themes: FIFA World Cup Qatar 2022TM. More than half a million visitors are expected during the month long tournament starting in November, 2022 (Qatar’s population is 2.5 million). We expect a positive impact across many parts of the Qatari economy not only during the event but also in the 9-12-month build-up prior to kick-off. Saudi home building. A key pillar of Crown Prince Mohammed bin Salman’s long term strategy is for more than 1 million homes to be built for low and middle-income families by 2030. Subsidised by the government, and helped by a raft of reforms, we believe this is more than a $150 billion opportunity over a decade and will energise large parts of the non-oil economy Expansion of Qatar’s LNG production capacity. A $45+ billion project to expand LNG production by more than 60%, from 77 to 126 million tonnes per year by 2027, will benefit many parts of Qatar’s economy and a number of regional companies that have exposure to this project. Exponential growth of regional e-commerce. With very high mobile penetration and among the fastest internet speeds in the world, the region is well set for decades of growth in e-commerce. A large eco-system of companies, from retailers, online market places, logistics companies, etc, will benefit. Screening process: ARI follows a multi-layer stock-screening process, which combines qualitative and quantitative filtering with top-down and bottom-up analysis. This narrows the 1,000+ or so listed regional companies down to a dynamic portfolio of select investments, which also meet our ethical principles. The investment team very regularly engages with managements of companies across the region to remain close to key decision makers and to keep refreshing a bottom-up picture of trends within economies. Investment Strategy and Process:

Investors who have risk tolerance that is associated with instruments that the fund invests in. Also, investors are always required to consult with their advisors prior to investing in the fund. Investors who invest in the Fund are categorized as: - Investors who share our belief that regional leaders understand the imperative of continuing to invest in their hydrocarbon production capabilities but also to diversify their economies. - Investors targeting absolute return over the medium term (18-24 months); the fund is not restricted by adherence to a benchmark - Investors wishing to have exposure to a fund bound by ethical principles, with a focus on responsible investments - Investors willing to tolerate the higher risks and volatility of investing primarily in equities - Investors who wish to invest in a fund with fees among the lowest amongst its peers - Investors who want a fund manager's incentives to be levered to generating exceptional returns for investors - Investors who wish to benefit from a fund able to capitalise on opportunities in Gulf equities and sukuk

| Fund facts | |

|---|---|

| Who can invest? |

All investors regardless of place of residence or nationality. |

| Fund currency |

QAR |

| Fund duration |

Open-ended |

| Investment focus |

Sharia-compliant GCC equities & Sukuk |

| Investment horizon |

18-24 months |

| Expected rate of return (Not guaranteed) |

Target return is 12% per annum |

| Capital guarantee |

The fund’s capital is not guaranteed |

| Dividend distribution |

The fund currently distributes a dividend twice a year, in January and July. This distribution is at the discretion of the fund manager and can be stopped at any point in time. |

| Lock-in period |

None |

| Subscription/ redemption |

Daily |

| Investor updates |

Investor newsletter and individual holding statement delivered by post and email upon client’s request. Monthly factsheets are also available here. |

| NAV calculation |

Daily |

| Founder |

AlRayan Bank QSC |

| Fund Manager |

AlRayan Investment LLC |

| Custodian |

HSBC Middle East Ltd |

| Auditor |

PricewaterhouseCoopers |

| Sharia Advisory Board | |

| FEES | |

|---|---|

| Subscription fee |

Up to 1% (upon subscription) |

| Management fee |

1.25% per annum (taken directly from fund on monthly basis) |

| Performance fee |

20% of NAV increase above 24%, over 2-years |

| SUBSCRIBERS | |

|---|---|

| Individuals Minimum subscription: |

QAR 35,000 (QAR 5,000 increments, subsequently) |

| Institutions Minimum subscription: |

QR 350,000 (QAR 50,000 increments, subsequently) |

Individuals

Required documents- Copy of national ID card (showing date & place of birth)

- Copy of passport (Not required to Qatari nationals)

- Evidence of physical address (if not ARB account holder)

- PEP Declaration form

- Taxation for self-certification

- 6 months bank statement showing the funds which will be invested

Institutions

Required documents- Copy of commercial registration issued by Min. Econ & Trade/ local licensing authority

- Copy of Memorandum or Articles of Association (or Prospectus if a Fund)

- Copies of national ID cards of owners and joint partners

- Names of shareholders who own more than 10% of capital

- Name, copy of national ID and specimen signature of authorized signatory

- Evidence of signatory’s power and authority to buy units on behalf of the entity (constitutive documents, power of attorney or Board resolution)

- PEP Declaration form

- Taxation for self-certification

- 6 months bank statement showing the funds which will be invested

For both individual and institutional investors, the originals of the above should be seen by the representatives of the founder or the fund manager. Alternatively, they can be certified as ‘true copy’ by a lawyer, accountant, compliance officer or other similarly qualified professionals.

For all investors outside of Qatar where original documents are not seen by a fund representative, they would need to be notarized by a public notary and attested by the local Qatar embassy and Ministry of Foreign Affairs in Qatar.

- Taxation for self-certification

For further information, please call +974 4425 3333, or contact your local AlRayan Bank branch or customer service representative

Risk Warning Past performance is not an indication of future results. The value of investments can go up as well as down. Before investing, investors should consider carefully information contained in the fund prospectus and addendums, including investment objectives, risks, charges and expenses. Investors must ensure they have sufficient knowledge, education and experience to make investment decisions. Neither the fund, founder, fund manager nor the custodian are tax consultants or provide any investment consultancy to invest in the fund. An investment is neither insured nor guaranteed by AlRayan Bank, AlRayan Investment nor any government agency. Although the fund seeks to preserve and grow the value of your investment, it is possible to lose money by investing in the fund. If in doubt, please seek independent legal, Sharia, tax and financial advice.

Disclaimer The information on this website does not constitute an offer or solicitation in any jurisdiction in which such offer or solicitation is not authorised. The Qatar Central Bank (QCB), Qatar Financial Markets Authority (QFMA) and the Ministry of Economy and Commerce of the State of Qatar take no responsibility for the accuracy of the statements and information contained in this website or for the performance based on this information, nor shall they have any liability to any person, an investor or otherwise, for any loss or damage resulting from reliance on any statement or information contained herein. If you do not understand the contents of this website you should consult an authorised financial advisor.